Vehicle donation tax deduction details Learn the way you could declare a tax deduction on the auto any time you donate it to Habitat for Humanity. Learn more

Like all kinds of other charities, this one particular depends on Charitable Grownup Rides and Services to process donated cars. Acknowledged cars consist of almost something that has an motor, is within the U.S., is in one piece and will be towed.

Wheels For Needs will let you know what is needed with your point out. Most states do require that you've a transparent title for the car or truck to have the ability to donate. Should you have other inquiries you are able to drop by our car or truck donation title FAQ to Get the car or truck title inquiries answered.

Is your automobile needing costly repairs? Was it not worthy of as much as you hoped for? Just feeling generous? Regardless of what your explanation, CARS can make donating your automobile effortless, and you could possibly even receive a tax deduction in the procedure

To optimize your car donation deduction, It is essential that you comprehend the IRS's procedures and laws. Delve in the labyrinth of IRS tips, And you will find which the deduction value hinges on two components: how the charity utilizes the car plus the motor vehicle's good sector benefit.

Should you be the executor of one's loved one’s estate, we would be content to work along with you to just accept the donation. Only the executor of your deceased particular person's estate can donate the get more info motor vehicle to charity. Ordinarily, the executor of 1's estate is set because of the deceased particular person's will. If no executor has become appointed–Maybe due to the fact there was no will or since the vehicle is the only asset remaining behind–you need to Call a legal professional to start out the process of having an executor appointed via the condition.

Beneath the new tax legislation, you're possible questioning just how your car donation will have an effect on your deductions this yr. Here is the deal: it isn't really as complex as you may be expecting. Here's a breakdown of the main adjustments:

No matter how the charity takes advantage of the vehicle, if you plan to claim that the car is really worth much more than $five hundred, you will need to get yourself a created acknowledgment from website the donation. That acknowledgment need to comprise:

Your contribution is not just an outdated auto; it is a would like granted, a aspiration fulfilled. It's a hospital take a look at produced less complicated, a medical process built possible. But it's actually not almost the youngsters. It can be about you way too, enjoying an active aspect in their Tale, silently championing their result in.

The Restrict on charitable deductions has been elevated from fifty% to 60% of your respective modified gross profits. It is a large perk if you're a substantial-money donor.

It is attainable which the charities you currently aid Have a very car or truck-donation method that you don't know about. Check with them to start with. read more If not, perform a little study, and locate a superior-undertaking charity that does the sort of work you like, inside the area you would like to target, and does that do the job effectively.

1st, confirm the charity's legitimacy. Question for his or her IRS letter of willpower and check their standing around the IRS's website.

You ought to be knowledgeable the tax Rewards from a donation count mainly on your taxable revenue check here plus the gross advertising price of the donated car.

Effectively recycled cars also enable cut down carbon emissions by slicing down the more info need to refine new supplies. In fact, recycling metal saves adequate Vitality to ability about eighteen million properties for any calendar year.

Kel Mitchell Then & Now!

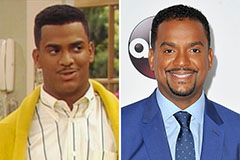

Kel Mitchell Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!